India: Helping essential, high-emitting businesses decarbonise is critical to addressing climate change, according to a recent perspective published by Canada Pension Plan Investment Board (CPP Investments). The perspective, “Investing to Enable an Economy-wide Evolution to a Low-Carbon Future,” highlights the opportunity decarbonisation presents for long-term investors, noting the need to address a particularly serious obstacle to decarbonisation: strategic sectors that are essential, high-emitting and hard-to-abate.

India: Helping essential, high-emitting businesses decarbonise is critical to addressing climate change, according to a recent perspective published by Canada Pension Plan Investment Board (CPP Investments). The perspective, “Investing to Enable an Economy-wide Evolution to a Low-Carbon Future,” highlights the opportunity decarbonisation presents for long-term investors, noting the need to address a particularly serious obstacle to decarbonisation: strategic sectors that are essential, high-emitting and hard-to-abate.

The perspective also outlines CPP Investments’ new investment approach which aims to identify, fund and support companies that are committed to creating value by lowering their emissions over time, consistent with CPP Investments’ time horizon advantage.

“High-emitting companies that successfully navigate the economy-wide evolution to a low-carbon future will preserve and deliver embedded value for patient long-term investors like CPP Investments,” said Deb Orida, Global Head of Real Assets & Chief Sustainability Officer. “This new investment approach complements the Fund’s ongoing commitment to investing in companies that have the potential to develop innovative climate technologies around the world and furthers our existing capabilities in technologies that enable the energy evolution.”

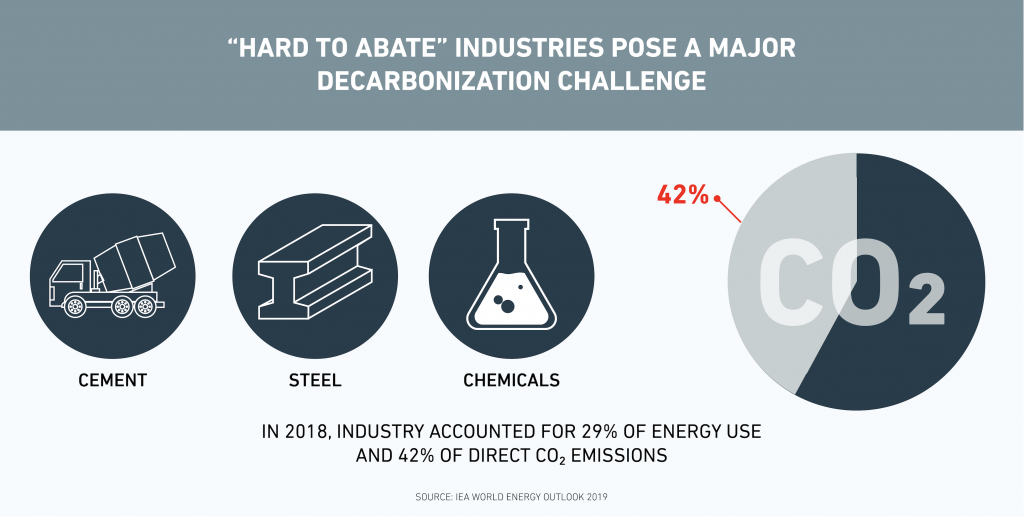

Strategic sectors that are essential, high emitting and hard-to-abate within this investment approach include agriculture, chemicals, cement, conventional power, oil and gas, steel and heavy transportation. The successful decarbonisation of these sectors is not only essential to meet wider net-zero ambitions, but also to sustain economic growth, stability and a responsible transition. CPP Investments plans to work in partnership with like-minded companies, industry leaders, investors, and other interested parties to build out a dedicated investment approach to support current and future portfolio companies in their evolution.

Strategic sectors that are essential, high emitting and hard-to-abate within this investment approach include agriculture, chemicals, cement, conventional power, oil and gas, steel and heavy transportation. The successful decarbonisation of these sectors is not only essential to meet wider net-zero ambitions, but also to sustain economic growth, stability and a responsible transition. CPP Investments plans to work in partnership with like-minded companies, industry leaders, investors, and other interested parties to build out a dedicated investment approach to support current and future portfolio companies in their evolution.

CPP Investments also released a related perspective today focusing on an additional key element of sustainable investing, “Financing a Greener Future,” highlighting green bonds as part of the Fund’s approach to deploying capital for projects with environmental benefits. The paper outlines how for green bonds to go from a fast-growing niche to a mainstream offering, standards will have to grow out of a mix of evolving draft rules into something closer to the bond market’s extant framework for governing how debt is rated, issued and evaluated for performance. The imperative is to improve green bond standards and practices quickly. Doing so can help the financial sector realize its enormous potential for guiding capital toward investments that support the transition to a low-carbon economy while also boosting returns. In 2018, CPP Investments was the world’s first pension fund to issue green bonds and has floated six more issuances since.

For more information, the “Investing to Enable an Economy-wide Evolution to a Low-Carbon Future” perspective can be found on the CPP Investments website here. The “Financing a greener Future” paper can be found here.