Poonam Choksi is the Head of Capacity Building at A.T.E. Chandra Foundation.

Poonam Choksi is the Head of Capacity Building at A.T.E. Chandra Foundation.

In alignment with the Indian Government’s Atmanirbhar Bharat philosophy, the Social Stock Exchange (SSE) serves as an innovative platform to unlock new domestic funding sources to bolster long-term development. The concept of a Social Stock Exchange (SSE) was initially introduced in the July 2019 financial budget by the then Hon’ble Finance Minister of India, Smt. Nirmala Sitharaman. SSEs enable NGOs and social businesses to raise funds by attracting ethical donors/investors keen on supporting organisations primarily dedicated to social missions. Its purpose is to bridge our dynamic capital markets with citizens to fulfil the Government’s social welfare objectives concerning inclusive growth and financial inclusion.

Enhancing transparency and increasing accountability establishes a structured environment conducive to systematic funding and investment in the social sector by Indian donors.

The social development sector in India primarily receives domestic funding from government-related sources, corporate social responsibility (CSR) initiatives, high-net-worth individuals (HNIs) and their foundations, and retail donors.

A key issue confronting stakeholders across these segments and NGOs/social businesses is the absence of a uniform framework for funding, utilisation, impact creation, measurement, disclosures, and reporting.

This lack of uniformity creates a sense of distrust between donors/investors and recipients, inflates transaction costs, and hampers the free flow of funds. Numerous other countries have encountered similar challenges and endeavoured to address them through SSE frameworks, but with limited or no success.

India’s SSE represents a distinct and bold initiative aiming to buck this trend and also serve as a global model by tackling many of the issues that have hindered earlier attempts worldwide.

The primary goal of the SSE platform is to address this mistrust. The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) conduct thorough due diligence on NPOs, scrutinising their financial, compliance, and governance systems to eliminate fraudulent organisations. The Securities and Exchange Board of India (SEBI) mandates that every NPO on the social stock exchange undergo a social impact assessment. The National Institute of Securities Markets (NISM) has devised a certificate programme to certify Social Assessors. This is to ensure that these professionals are trained and qualified to lead impact assessments, thereby ensuring accountability.

Importance and Benefits for Donors

Transparency, Trust, and Accountability: Retail donors, those contributing less than INR 1 Lakh annually, often encounter significant trust and credibility issues when donating to Non-Profit Organisations (NPOs). Finding trustworthy organisations aligned with their interests and maintaining robust compliance systems is a common challenge.

The primary goal of the SSE platform is to address this mistrust. The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) conduct thorough due diligence on NPOs, scrutinising their financial, compliance, and governance systems to eliminate fraudulent organisations. The Securities and Exchange Board of India (SEBI) mandates that  every NPO on the social stock exchange undergo a social impact assessment. The National Institute of Securities Markets (NISM) has devised a certificate programme to certify Social Assessors. This is to ensure that these professionals are trained and qualified to lead impact assessments, thereby ensuring accountability. To date, 4,764 individuals have enrolled, 3,747 have participated, and 1,372 have passed. Additionally, NPOs must submit quarterly fund utilisation certificates, to further safeguard donor interests and foster trust and credibility in the social sector.

every NPO on the social stock exchange undergo a social impact assessment. The National Institute of Securities Markets (NISM) has devised a certificate programme to certify Social Assessors. This is to ensure that these professionals are trained and qualified to lead impact assessments, thereby ensuring accountability. To date, 4,764 individuals have enrolled, 3,747 have participated, and 1,372 have passed. Additionally, NPOs must submit quarterly fund utilisation certificates, to further safeguard donor interests and foster trust and credibility in the social sector.

Standardisation: The SSE has introduced a unified framework for social impact assessment in collaboration with self-regulatory organisations such as The Institute of Chartered Accountants of India (ICAI), The Institute of Company Secretaries of India (ICSI), and The Institute of Cost Accountants of India (ICMAI). This standardised reporting for NPOs listed on the stock exchanges allows retail investors to assess and compare performance across organisations. Standardised reporting ensures that NPOs commit to clear outputs in their fundraising documents and report their progress annually, enabling investors to make well-informed decisions. This level of standardisation will also streamline processes for NPOs, as they can share the same impact assessment report with all their donors, unlike in the case of CSR where they must create separate reports for each institution.

Standardisation: The SSE has introduced a unified framework for social impact assessment in collaboration with self-regulatory organisations such as The Institute of Chartered Accountants of India (ICAI), The Institute of Company Secretaries of India (ICSI), and The Institute of Cost Accountants of India (ICMAI). This standardised reporting for NPOs listed on the stock exchanges allows retail investors to assess and compare performance across organisations. Standardised reporting ensures that NPOs commit to clear outputs in their fundraising documents and report their progress annually, enabling investors to make well-informed decisions. This level of standardisation will also streamline processes for NPOs, as they can share the same impact assessment report with all their donors, unlike in the case of CSR where they must create separate reports for each institution.

The SSE serves as a potent platform for NGOs to enhance visibility and attract new donors for their social impact projects. Historically, NPOs have struggled to secure funds from retail donors. However, in recent times, young professionals and next-gen philanthropists have displayed keen interest in addressing India’s social issues and contributing to nation-building. They actively seek organisations capable of demonstrating effective solutions. The SSE facilitates connections between these stakeholders, amplifying support and advocacy for various causes.

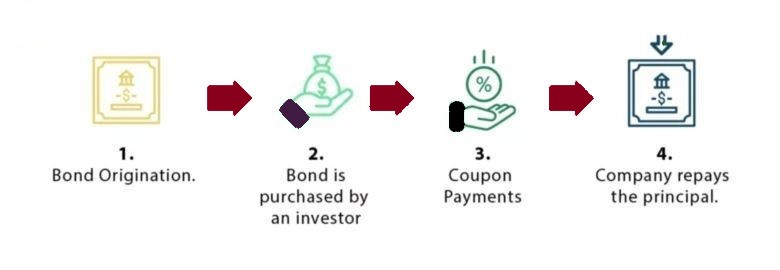

Incentives for Participation: The introduction of innovative financial instruments such as Zero Coupon Zero Principal (ZCZP) bonds is now approved for tax deduction under Section 80G of the Income Tax Act 1961, providing donors with a level playing field compared to other retail giving platforms. This measure is expected to significantly boost donor participation and increase overall funding to the social sector. The first eight NPOs listed on the NSE-SSE have already raised approximately INR 11.3 Crores through ZCZP bonds, with four to five more in the pipeline for listing in the coming months. Benefits for NGOs

Benefits for NGOs

Trust and Credibility: The COVID-19 pandemic underscored the critical role of the social sector in saving lives, reaching the last mile, and supporting the most vulnerable and marginalised communities. Despite their significant contributions, NGOs have long grappled with trust issues from donors and governments. The SSE platform, endorsed by SEBI, brings much-needed credibility and attention to a sector that has been addressing social issues for over 75 years. With millions of beneficiaries served, livelihoods provided to 2.7 million people, and a contribution of 2 per cent to the nation’s GDP, as reported by this study, this initiative showcases the collaborative effort of society, government, and markets (samaaj, sarkaar, and bazaar) in addressing persistent social challenges at scale.

Awareness and Brand Building: The SSE serves as a potent platform for NGOs to enhance visibility and attract new donors for their social impact projects. Historically, NPOs have struggled to secure funds from retail donors. However, in recent times, young professionals and next-gen philanthropists have displayed a keen interest in addressing India’s social issues and contributing to nation-building. They actively seek organisations capable of demonstrating effective solutions. The SSE facilitates connections between these stakeholders, amplifying support and advocacy for various causes. With over six million active users, Zerodha, India’s largest stockbroker, wields significant influence, presenting an opportunity to encourage citizens to contribute positively to social and economic development.

Awareness and Brand Building: The SSE serves as a potent platform for NGOs to enhance visibility and attract new donors for their social impact projects. Historically, NPOs have struggled to secure funds from retail donors. However, in recent times, young professionals and next-gen philanthropists have displayed a keen interest in addressing India’s social issues and contributing to nation-building. They actively seek organisations capable of demonstrating effective solutions. The SSE facilitates connections between these stakeholders, amplifying support and advocacy for various causes. With over six million active users, Zerodha, India’s largest stockbroker, wields significant influence, presenting an opportunity to encourage citizens to contribute positively to social and economic development.

Promoting Inclusion: A substantial portion of funding from Corporate Social Responsibility (CSR) and institutional philanthropy foundations is typically directed towards addressing social issues in health, education, environment, and sustainability. However, this focus often marginalises community-based NGOs working on inclusion and equity for the most underprivileged communities, constraining their ability to raise funds and address local social issues effectively. The SSE platform tackles this gap by facilitating the registration and listing of a diverse range of social enterprises and NGOs. Under the current mandate, NPOs with a track record of spending over INR 50 Lakhs in the past three years can register and raise funds through the platform. This inclusion empowers smaller and lesser-known organisations to access funding and support, promoting a more equitable distribution of resources.

Opening the SSE to CSR contributions could be a significant step in encouraging its growth and development. While companies stand to benefit from the robust due diligence and reporting framework of the SSE, their familiarity with capital markets and stock exchanges could facilitate their embrace of SSE as a mechanism. This alignment could result in a substantial win for both CSR and SSE. It is noteworthy that all reporting requirements mandated for NGOs receiving CSR funds have already been included into the SSE framework, thereby creating a seamless reporting process for NPOs as well.

Building an Ecosystem Around SSE: To fully harness the potential of the SSE, it is crucial to establish a supportive and conducive ecosystem. According to the India Philanthropy Report 2024 by philanthropy organisation Dasra, and global management consulting firm Bain & Co., India’s social sector spending in FY23 stood at around INR 23 Lakh Crores, accounting for 8.3 per cent of the gross domestic product (GDP). This figure falls below the NITI Aayog recommendation of 13 percent of GDP.

In FY23, member countries of the Organisation for Economic Co-operation and Development (OECD) and the BRICS nations reported significantly higher spending rates of 24 per cent and 11 per cent, respectively (based on FY22 data). However, India has not kept pace with its OECD and BRICS counterparts due to moderate growth in Corporate Social Responsibility (CSR) and donations from high-net-worth individuals (HNIs) or affluents, despite a growing donor pool. We believe that SSE has the potential to significantly contribute to bridging this gap, and implementing changes in the enabling ecosystem can expedite the adoption of SSE at scale.

Opening the SSE to CSR contributions could be a significant step in encouraging its growth and development. While companies stand to benefit from the robust due diligence and reporting framework of the SSE, their familiarity with capital markets and stock exchanges could facilitate their embrace of SSE as a mechanism. This alignment could result in a substantial win for both CSR and SSE. It is noteworthy that all reporting requirements mandated for NGOs receiving CSR funds have already been included in the SSE framework, thereby creating a seamless reporting process for NPOs as well.

Conclusion

The Social Stock Exchange represents a transformative approach to funding social initiatives, offering significant benefits to donors and Non-Profit Organisations (NPOs). By fostering transparency, accountability, and credibility, the SSE helps build trust and attract more resources to the social sector. However, to realise its full potential, it is crucial to develop a comprehensive ecosystem that supports the SSE’s operations and growth. Through a collaborative effort involving regulatory bodies, NGOs, and donors, the SSE can become a cornerstone of sustainable social impact, driving positive change and addressing pressing societal challenges.

The Social Stock Exchange represents a transformative approach to funding social initiatives, offering significant benefits to donors and Non-Profit Organisations (NPOs). By fostering transparency, accountability, and credibility, the SSE helps build trust and attract more resources to the social sector. However, to realise its full potential, it is crucial to develop a comprehensive ecosystem that supports the SSE’s operations and growth. Through a collaborative effort involving regulatory bodies, NGOs, and donors, the SSE can become a cornerstone of sustainable social impact, driving positive change and addressing pressing societal challenges.